Hook: Why “Sell My House in Any Condition” Is a Smart Strategy Now If you are thinking, “I need to sell my house in any condition,” you are not alone. According to multiple industry reports, more than 1 in 5 homes sold in the U.S. today require moderate to significant repairs. Yet many sellers still waste months (and thousands of dollars) trying to renovate before listing, only to discover buyers are discounting heavily for risk and delays. This guide walks you step by step through how to sell a property exactly as it sits—no repairs, no upgrades, and minimal disruption—while still making a sound financial decision.

Table of Contents

-

Step 1: Define Your Goal Before You Sell My House in Any Condition

-

Step 3: Choose the Best Strategy to Sell My House in Any Condition

-

Conclusion: Your Next Steps to Sell My House in Any Condition

Key Takeaways

| Key Point | What You Will Learn | Why It Matters |

|---|---|---|

| Define your objective | How to clarify whether speed, price, or certainty is your top priority | Aligns your strategy with your real financial and timing needs |

| Assess condition realistically | A simple framework to categorize property condition and repair risk | Helps you price correctly and choose the right buyer type |

| Compare sale options | Side‑by‑side comparison of listing, cash buyers, and hybrid approaches | Prevents you from over‑spending on repairs or accepting the wrong offer |

| Prepare as‑is paperwork | What disclosures and documents you still need, even in an as‑is sale | Reduces legal risk and buyer disputes later |

| Negotiate a clean close | Tactics to reduce contingencies and delays with investors and cash buyers |

Step 1: Define Your Goal Before You Sell My House in Any Condition Before you decide how to sell my house in any condition, you must define what success looks like. Most sellers are juggling three competing priorities: – Speed of sale – Net cash in hand – Certainty and convenience You cannot maximize all three at once. Being explicit about your top priority will drive every other decision. ### 1.1 Clarify Your Primary Constraint Ask yourself these questions and write down the answers: – What is my latest acceptable closing date? – How much cash do I realistically need to walk away with? – How much time and energy can I personally invest in this sale? If you: – Face foreclosure, a job relocation, probate, or divorce, speed and certainty usually matter more than squeezing out every last dollar. – Have strong cash reserves and no deadline, you may tolerate a longer, more traditional sale to maximize price. Pro tip: Set a non‑negotiable “must close by” date and a minimum net number on paper before talking to any buyers. This prevents emotional decision‑making later. ### 1.2 Translate Goals Into a Strategy Profile Based on your answers, you can broadly classify your profile: | Profile Type | Main Priority | Best Fit Strategy (Typically) |

| — | — | — |

| Urgent seller | Speed and certainty | Cash buyer / professional investor in as‑is condition |

| Value‑maximizing seller | Highest price, can wait | Traditional listing with agent, light pre‑sale work |

| Balanced seller | Mix of price and speed | Hybrid strategies or competitive bids from both investors and owner‑occupants | Once your profile is clear, you are ready to evaluate your property’s condition and risk.

Step 2: Honestly Assess the Property’s Condition and Risk To sell my house in any condition intelligently, you must understand what “any condition” really means in the eyes of buyers, appraisers, and lenders. ### 2.1 Categorize Property Condition Think in four categories: – Turnkey: Recently updated, very few repairs needed – Dated but functional: Older finishes, systems working, cosmetic updating needed – Deferred maintenance: Obvious repairs, older systems, possibly safety issues – Heavy distress: Structural problems, major systems failing, code or permit issues Most “sell my house in any condition” situations fall into the last two categories. Pro tip: Walk the property with a notebook or phone and document issues room by room. This becomes your baseline for conversations with buyers or investors. ### 2.2 Identify Deal‑Breaker Issues for Traditional Buyers Some defects severely limit traditional financing, even if a buyer loves the property. Common red flags: – Roof at end of life or actively leaking – Significant foundation cracks or movement – Non‑functional HVAC, electrical hazards, or plumbing failures – Mold, moisture intrusion, or fire damage – Unpermitted additions or garage conversions When a property has multiple red flags, many traditional buyers will either walk away or demand large credits. Appraisers and lenders may also decline the loan. ### 2.3 Estimate Repair Risk vs. Actual Cost If you are not a contractor, it is easy to underestimate both cost and risk. Consider: – Visible repairs: items you can see and quantify (e.g., flooring, paint) – Hidden risk: items uncovered only after opening walls, roofs, or foundations – Time risk: permitting, inspections, contractor scheduling | Factor | Traditional DIY/Contractor Route | Selling As‑Is to Investor |

| — | — | — |

| Upfront cash required | High | Low to none |

| Time to complete work | Weeks to months | None |

| Risk of cost overruns | High | Shifted to buyer |

| Impact on sale price | Potentially higher | Discounted but faster, simpler | Pro tip: If you do not have at least a 20–30% contingency budget on top of repair estimates, you are usually better off shifting that risk to a professional buyer.

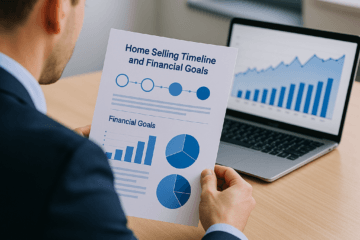

Step 3: Choose the Best Strategy to Sell My House in Any Condition Now that you understand both your goals and your property’s condition, you can choose the most appropriate path to sell my house in any condition. ### 3.1 Compare Your Core Options For most sellers, three primary paths exist: – List on the open market (traditional agent) – Sell directly to a cash buyer or real estate investor – Use a hybrid or “best of both” approach | Option | Pros | Cons | Best For |

| — | — | — | — |

| Traditional listing | Potentially highest top‑line price; widest exposure | Prep costs, showings, repairs/credits, longer timelines, financing risk | Properties in decent condition; sellers who can wait |

| Direct cash buyer | Fast closings, as‑is, no showings, fewer contingencies | Lower price vs. fully renovated retail value | Distressed properties, urgent situations, high repair risk |

| Hybrid strategies | Some market exposure plus investor options | More complex to manage | Sellers balancing price and speed | For a deeper comparison of these models, including when each makes financial sense, review: We Buy Houses As Is: Comparing Cash Buyers, Traditional Sales, and Hybrid Options. Pro tip: Obtain at least one professional cash offer and one broker price opinion (BPO) before committing. Having both numbers gives you a reality check on your real options. ### 3.2 When a Professional Investor Is Typically Optimal A reputable investment company like Casey Sullivan Real Estate is often the most rational choice when: – You need to close in 7–30 days, not months – The property has significant deferred maintenance or safety issues – You cannot or do not want to invest additional cash into repairs – You are managing an estate, inherited property, or long‑distance sale Investors generate profit by taking on risk, managing construction, and reselling or renting over time. In exchange, you receive: – A straightforward as‑is offer – Fewer or no repair requests – Flexible closing date – Often, assistance with cleanup, junk removal, or tenants ### 3.3 When a Traditional Sale May Still Make Sense If your home is more “dated” than “distressed,” a traditional listing could still work. You may: – Execute light, high‑ROI improvements (paint, landscaping, cleaning) – Price slightly below renovated comparables to attract multiple offers – Offer a closing cost credit instead of doing repairs yourself For detailed tactics on maximizing price while still moving quickly, see: 7 Proven Strategies to Sell My Home Fast Without Losing Money. Pro tip: If an agent insists you must complete expensive renovations to list, get a second opinion from a professional cash buyer to see if the added risk is justified.

Step 4: Prepare Documents and Disclosures for an As‑Is Sale Even when you sell my house in any condition, you are not exempt from documentation and disclosure obligations. An as‑is sale primarily shifts repair responsibility; it does not remove your duty to be truthful. ### 4.1 Understand What “As‑Is” Actually Means In most states, “as‑is” means: – The buyer accepts the property in its current physical condition – The seller will not complete repairs or provide credits (unless specifically agreed) – The buyer still typically has the right to inspect It does not mean: – You can conceal known material defects – You can ignore state‑mandated disclosures – The buyer has no recourse in cases of fraud or misrepresentation Pro tip: Treat your disclosure forms as risk‑management tools, not obstacles. The more transparent you are, the lower your legal exposure later. ### 4.2 Core Documents You Should Assemble Before you market or negotiate, gather: – Title information: deed, title insurance policy, mortgage statements – Property tax statements: current and any delinquent amounts – Utility and service records: proof of recent work on roof, HVAC, plumbing, etc. – HOA documents (if applicable): rules, fees, special assessments – Disclosure forms: state‑specific property disclosure, lead paint, etc. Having these ready makes an investor’s underwriting process faster, which often translates into a quicker closing. ### 4.3 Disclosures: Traditional Buyer vs. Investor While requirements vary by state, here is a general comparison: | Aspect | Traditional Retail Buyer | Professional Investor |

| — | — | — |

| Disclosure forms required | Typically full state package | Often similar, but some investors accept minimal forms depending on state |

| Inspection contingencies | Common and often lengthy | Short or waived entirely |

| Renegotiation after inspection | Very common | Less common; as‑is usually priced in | Professional buyers like Casey Sullivan Real Estate are accustomed to purchasing distressed properties and typically streamline the process. For a detailed cash‑sale workflow, including how to evaluate offers and timelines, review: How to Sell My House Fast for Cash: A Complete Professional’s Guide. Pro tip: Disclose material issues you know about—foundation movement, leaks, prior fires—even if the buyer is an investor. It is the best way to avoid surprises that can delay or derail closing.