When a property has significant defects, title complications, or serious time pressure, traditional listing strategies often break down.

In these situations, choosing the right home buyers for problem properties becomes a business-critical decision, affecting not just how quickly you close, but how much risk you take on and how much capital you ultimately preserve.

Understanding the trade-offs among investors, institutional buyers, and conventional purchasers can help you move from uncertainty to a clear, actionable plan. Table of Contents

- 1. Understanding Home Buyers

- 2. Option 1: Professional Real Estate Investors

- 3. Option 2: Institutional iBuyers

- 4. Option 3: Local Flippers

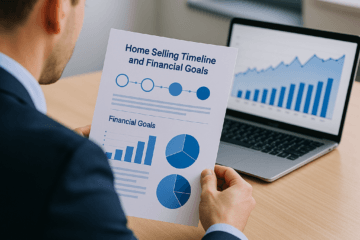

Key Takeaways Option

Best For

Primary Advantages Key Risks / Trade-Offs Professional Investors / Direct Buyers

Serious property issues, urgent timelines, owners needing certainty

Fast closing, as-is purchases, high certainty of execution Lower gross price versus top-market retail listing iBuyers / Online Cash Offer Platforms

Homes with moderate defects in major metro markets

Structured processes, digital convenience Tight condition criteria, fees, and potential for offer changes after inspection Traditional Financed Buyers

Properties in reasonably financeable condition, flexible timelines

Potentially higher sale price in balanced markets Inspection re-trades, financing fall-through, limited appetite for severe issues

1. Understanding Home Buyers

for Problem Properties Problem properties are homes that face material obstacles to a conventional sale: substantial deferred maintenance, structural issues, code violations, unresolved title or estate questions, non-paying tenants, or urgent circumstances such as foreclosure timelines. In these cases, the pool of qualified and willing buyers narrows significantly, and the normal open-market process can become slow, uncertain, and capital-intensive. Identifying the right home buyers for problem properties means matching the property’s risk profile with a buyer whose business model is designed to absorb that risk. Need to Sell My House Quickly? 5 Professional Options Compared for Speed, Certainty, and Net Proceeds] There are four primary categories of home buyers for problem properties: professional real estate investors and direct buyers, institutional iBuyers and online cash platforms, local flippers and small investment groups, and traditional owner-occupant buyers using financing.

Each group evaluates risk, pricing, and timelines differently.

Investors and direct buyers typically prioritize speed and certainty, while retail buyers focus on condition and financing requirements.

The right choice depends on whether your priority is timeline, net proceeds, or minimizing operational friction. How to Sell Inherited Property Fast: A Professional Comparison of Your Best Options] From a business perspective, the decision resembles choosing between different capital partners.

Some options offer a lower headline price but a high probability of closing and minimal additional investment from you.

Others may promise a higher theoretical market value but require repairs, holding costs, and the risk of delayed or failed closings.

For homeowners who are business professionals, it is useful to frame the analysis as a trade-off between risk-adjusted net proceeds and operational complexity. [7 Proven Strategies to Sell My Home Fast Without Losing Money] Casey Sullivan Real Estate operates in the first category: a professional real estate investment company that acquires residential properties in as-is condition across many U. S. cities.

If your immediate concern is, “I need to sell my house quickly,” you can compare professional options with more detail in the article “Need to Sell My House Quickly? 5 Professional Options Compared for Speed, Certainty, and Net Proceeds” at caseysullivanrealestate.com That resource, combined with the comparisons in this article, will help you design a selling strategy that aligns with your financial and timing objectives. How to Sell My House Fast in [City] [State]: A Step-by-Step Professional Guide

-

Problem properties narrow the pool of qualified buyers and increase transaction risk.

-

Different buyer types monetize risk and time in different ways, affecting your net outcome.

-

Your optimal strategy depends on whether speed, certainty, or highest possible price is your top priority.

Buyer Type

Tolerance for Property Issues

Typical Closing Speed

Condition Requirements Ideal Use Case Professional Investors / Direct Buyers High | 7–21 days

As-is; wide tolerance Serious defects, foreclosure, complex situations iBuyers / Online Cash Platforms Low to Moderate | 10–30 days

Near financeable condition Cosmetic issues, light repairs, major metros Local Flippers / Small Groups Moderate to High | 14–45 days

Prefer fixable defects Renovation potential, value-add projects Traditional Financed Buyers Low | 30–60+ days

Must meet lender guidelines Standard homes with manageable repairs

**

Pro tip:** Before requesting offers, document your property’s condition, any code or title issues, and current carrying costs.

Treat this like a brief investment memo; it will help you quickly determine which category of buyer is realistically able to transact on your specific situation.# 2. Option 1: Professional Real Estate Investors

and Direct Buyers Professional real estate investors and direct home-buying companies are often the most specialized home buyers for problem properties. Their business model is built on acquiring homes in as-is condition, often with substantial physical, legal, or financial complexities. They typically underwrite transactions quickly, utilize internal or private capital rather than traditional mortgages, and can move from offer to closing in a matter of days rather than months.

For owners dealing with imminent foreclosure, probate complexity, or significant property damage, this category frequently offers the most reliable path to execution. Direct Home Sale to Investor: 5 Professional Options Compared for Speed, Certainty, and Net Proceeds] The core advantages of professional investors and direct buyers include speed, certainty, and operational simplicity.

There is usually no requirement for repairs, cleaning, or staging; inspections are streamlined and focused on underwriting rather than renegotiation; and buyers are prepared for issues such as outdated systems, code violations, or non-performing tenants.

This approach reduces your exposure to ongoing holding costs such as taxes, insurance, utilities, and association fees.

While the purchase price may be lower than a top-of-market retail sale, the risk-adjusted net proceeds can be competitive once avoided costs and reduced time-on-market are factored in. How to Sell My Home Quickly Because of Foreclosure: A Complete Professional Guide] The main trade-off is that professional investors must price in both risk and the capital required to reposition the property.

Their offers are driven by after-repair value models, renovation budgets, market volatility, and target returns.

For homeowners with flexible timelines and properties that are easily financeable, a conventional listing may still yield a higher gross price.

However, for clearly distressed properties or time-sensitive situations, this category of home buyers for problem properties tends to provide the most predictable result with the fewest contingencies.

Casey Sullivan Real Estate operates in precisely this space, focusing on homeowners who need a fast, hassle-free exit.

If you are facing foreclosure or significant financial pressure, you may find the article “How to Sell My Home Quickly Because of Foreclosure: A Complete Professional Guide” at caseysullivanrealestate.com useful.

For those evaluating a direct sale versus other investor options, the guide “Direct Home Sale to Investor: 5 Professional Options Compared for Speed, Certainty, and Net Proceeds” at caseysullivanrealestate.com offers a structured comparison framework.

-

Fast, as-is purchases with minimal preparation required.

-

High tolerance for physical defects, delays, and legal complexity.

-

Offers often based on clear, transparent investment criteria.

Metric

Typical Outcome with Professional Investors Impact on Seller Average Closing Timeline | 7–21 days in many markets Reduces holding costs and timeline risk Repair Obligations

None – purchased as-is No upfront capital or project management required Financing Contingencies

Rare; often cash or private funding Lower probability of last-minute deal failure Price vs.

Full Retail Listing

Discounted to reflect repairs and risk Potentially lower headline price, but higher certainty and less friction

**

Pro tip:** When engaging with professional investors, request a breakdown of how they derived their offer (after-repair value, estimated renovation, and target margin). This level of transparency allows you to benchmark competing offers and understand whether the pricing assumptions are realistic.# 3. Option 2: Institutional iBuyers

and Online Cash Offer Platforms Institutional iBuyers and online cash offer platforms entered the market to provide a technology-driven alternative to traditional selling. They typically use automated valuation models and standardized processes to make relatively quick offers, often with a high degree of digital convenience. For properties in reasonably good condition, these platforms can be attractive home buyers for problem properties that are more cosmetic than structural, such as outdated finishes, minor repairs, or mild deferred maintenance.

However, institutional iBuyers usually have strict acquisition criteria.

Many will not purchase properties with significant structural issues, extensive water or fire damage, serious code violations, or complex title or occupancy problems.

For more severe cases, they may either decline to offer or adjust their pricing significantly after an in-person inspection.

Additionally, service fees, repair credits, and other transaction costs can materially affect your net proceeds.

For homeowners, the headline offer should be evaluated alongside the estimated deductions and the risk of post-inspection renegotiation.

From a timing standpoint, iBuyers typically close faster than a conventional financed buyer but slower than a specialized direct investor.

They are heavily dependent on internal risk models, seasonal market conditions, and capital availability, which can influence both offer frequency and pricing.

For moderately distressed homes in major metropolitan areas, iBuyers can present a middle-ground option: more convenience than a traditional listing, but without the same breadth of tolerance that dedicated home buyers for problem properties exhibit.

If your property is inherited and in relatively decent condition but feels outdated or cluttered, you may want to compare this route against other strategies.

The article “How to Sell Inherited Property Fast: A Professional Comparison of Your Best Options” at caseysullivanrealestate.com provides a structured overview of sale strategies, including when an iBuyer, investor, or traditional listing may be most suitable in inherited situations.

-

Digital convenience with online offers and standardized processes.

-

Best suited for homes with light to moderate condition issues.

-

Strict criteria often exclude severely distressed or highly complex properties.

Consideration iBuyer / Online Cash Platforms Impact on Problem Property Sellers Condition Flexibility

Low to moderate; strict thresholds Severely distressed homes often do not qualify Pricing Transparency

Initial offers may be adjusted after inspection Net proceeds can change late in the process Fee Structure

Service fees plus repair credits are common Reduces net proceeds compared to headline price Market Coverage

Concentrated in larger metro areas Limited applicability in smaller cities or rural markets

**

Pro tip:** When reviewing an iBuyer offer, focus on the estimated net proceeds line after fees, repair allowances, and closing costs.

Then compare that net figure to investor offers and a realistic, not idealized, listing scenario that includes projected repairs, time-on-market, and carrying costs.# 4. Option 3: Local Flippers

and Small-Scale Investment Groups Local flippers and small-scale investment groups represent a hybrid category of home buyers for problem properties. They typically focus on renovation projects within a defined geographic area, targeting homes where they can add value through cosmetic upgrades, layout improvements, or moderate structural work. Unlike institutional iBuyers, local investors may be more flexible about condition, especially if they have in-house construction capabilities or established contractor relationships.

The advantages of working with local flippers include potentially competitive offers in neighborhoods they know well, and a willingness to tackle renovations that exceed the appetite of most retail buyers.

They may see design or repositioning opportunities that national models overlook, particularly in transitioning neighborhoods or niche submarkets.