For many business professionals, time certainty, and risk management matter more than squeezing out the last dollar on a home sale. When you need to close quickly—whether due to relocation, divorce, inheritance, or a looming foreclosure—a direct home sale to investor can bypass months of showings, repairs, and negotiations. However, not all investor solutions are created equal, and choosing the wrong approach can cost you both money and control. Table of Contents

-

2. Option 1: Local Professional Cash Investor (Casey Sullivan Real Estate Model).

-

4. Option 3: Wholesalers and Assignment Investors Wholesalers operate differentl.

Key Takeaways Option Ideal

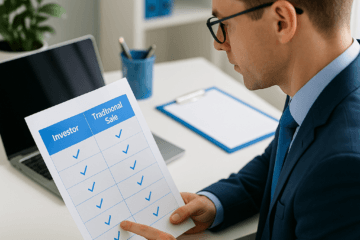

For Primary Advantages Key Risks/Trade-Offs Local professional cash investor Owners needing fast, as-is sale with clear communication Speed, flexibility, direct decision-maker, no repairs or showings Potentially lower sale price than top-of-market listing iBuyer / institutional investor Newer homes in major metros, predictable timelines Standardized process, digital convenience, quick offers Service fees, repair credits, limited coverage areas Wholesaler / assignment investor Sellers prioritizing speed who are less price-sensitive Very rapid offers, minimal effort required from seller Deep discounts, contract complexity, limited transparency

1. Why Consider a Direct Home Sale to Investor Instead of a Traditional Listing?

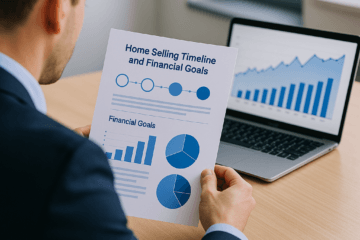

A direct home sale to investor is fundamentally different from a traditional listing on the open market. Instead of preparing the property, hiring an agent, staging, managing showings, and waiting for buyer financing, you sell directly to a buyer who is ready to purchase your home as-is, usually with cash or non-contingent funds. For many owners—especially business professionals balancing demanding schedules—this approach replaces uncertainty and disruption with a relatively predictable, streamlined transaction. [7 Strategic Ways to Sell My House Fast During Divorce (Without Losing Control or Money)

The primary trade-off is clear: in exchange for speed, certainty, and convenience, you may net slightly less than the theoretical maximum you could achieve with a perfectly executed traditional listing in an ideal market. However, when you consider carrying costs (mortgage, taxes, insurance, utilities), opportunity cost of your time, and the risk of deals falling through, a direct home sale to investor often compares favorably from a total-cost and risk-adjusted standpoint. In volatile or declining markets, the ability to lock in a firm price and close quickly can be especially valuable. How to Sell Inherited Property Fast: A Professional Comparison of Your Best Options

Direct investor sales are particularly relevant in life events where timing and control are critical. If you are navigating a divorce, a coordinated and predictable sale may matter more than a marginally higher sale price. If you have inherited property that you do not plan to occupy or manage, monetizing it efficiently can be more practical than undertaking repairs and marketing. And if you are facing foreclosure, a strategic direct sale can help protect equity and your credit profile. Resources such as "7 Strategic Ways to Sell My House Fast During Divorce (Without Losing Control or Money)" and "How to Sell Inherited Property Fast: A Professional Comparison of Your Best Options" on Casey Sullivan Real Estate provide deeper guidance on those specific scenarios. [7 Professional Strategies for a Quick Closing Home Sale Without Unnecessary Stress

From a risk management perspective, a direct home sale to investor also reduces exposure to inspection renegotiations, appraisal gaps, and buyer financing failures—issues that routinely derail traditional deals. Investors typically underwrite properties based on clear criteria, often rely on cash funding, and are prepared to assume responsibility for repairs and future market conditions. For many owners, converting an uncertain asset into a known outcome within days or weeks, rather than months, is a compelling strategic decision. [7 Proven Strategies to Sell My Home Fast Without Losing Money

-

Eliminates need for repairs, staging, and multiple showings

-

Reduces timeline from months to weeks or even days

-

Provides higher certainty of closing compared to financed buyers

-

Shifts repair and market risk from seller to investor

Pro tip: Quantify your real holding costs—mortgage, taxes, insurance, utilities, and maintenance—over the next 3–6 months. Comparing those costs against a modest price discount in a direct home sale to investor often clarifies which option truly maximizes your net position.# 2. Option 1: Local Professional Cash Investor (Casey

Sullivan Real Estate Model) Working with a local professional cash investor is the most direct and transparent version of a direct home sale to investor. Firms such as Casey Sullivan Real Estate purchase residential properties in as-is condition using their own capital or established funding partners. This means you are negotiating with the actual decision-maker, not an intermediary, which accelerates the process and reduces miscommunication. In many cases, you can receive a firm cash offer within 24–48 hours and close in as little as 7–14 days, subject to clear title. How to Sell My House Without a Realtor: A Step‑by‑Step Professional Guide] The financial structure with a professional cash investor is typically straightforward: there are no listing commissions, no repair obligations, and often no seller-paid closing costs. Instead of paying 5–6% in agent commissions and investing in repairs and updates, you accept a single net offer. While the headline price may be lower than a retail sale, the difference is partially offset by what you save in commissions, repairs, holding costs, and reduced risk of failed transactions. For owners with tight timelines, this simplicity is a material advantage. How to Sell My Home Quickly Because of Foreclosure: A Complete Professional Guide] Another strength of this model is flexibility. Professional investors are accustomed to situations involving divorce, probate, relocation, and foreclosure and can often structure terms that align with your constraints—for example, allowing you to remain in the home for a short period after closing via a post-closing occupancy agreement. If you are facing foreclosure, a firm, fast investor offer can be integrated with strategies like those outlined in "How to Sell My Home Quickly Because of Foreclosure: A Complete Professional Guide" to help you preserve equity and avoid a forced sale. Casey Sullivan Real Estate focuses on speed and a low-friction process, particularly for business professionals who value clarity and minimal disruption. Their approach aligns with strategies described in "7 Professional Strategies for a Quick Closing Home Sale Without Unnecessary Stress" and "7 Proven Strategies to Sell My Home Fast Without Losing Money." By combining a direct home sale to investor with disciplined decision-making and clear timelines, many sellers can achieve both speed and defensible financial outcomes.

-

As-is purchase: no repairs, cleaning, or upgrades required

-

No listing, photography, staging, or public marketing

-

Flexible closing date and potential rent-back options

-

-

- Direct negotiation with the end buyer rather than an intermediary Factor Local Professional Cash Investor Traditional Agent Listing Average timeline to closing | 7–21 days | 45–90+ days

-

-

Commissions and fees Typically 0% commissions: 5–6% agent commission plus closing costs

-

Risk of buyer financing failure Low (mostly cash): Moderate to high (financing contingent)

Pro tip: When reviewing a cash offer from a local professional investor, ask for a simple net sheet that itemizes what you will receive at closing compared to a realistic traditional listing scenario. This side-by-side view makes it easier to see whether the direct home sale to investor is financially justified for your priorities.# 3. Option 2: iBuyers and Institutional Investors

iBuyers and institutional investors represent a more standardized, technology-driven version of a direct home sale to investor. These companies use algorithms and large data sets to generate offers, often through an online portal. For eligible properties—typically newer homes in major metropolitan areas—sellers can receive a preliminary offer rapidly, sometimes within hours. The value proposition centers on convenience: online document uploads, app-based communication, and a predictable, process-driven transaction.

However, the apparent simplicity of the iBuyer model often masks several important cost components. While you avoid traditional listing commissions, iBuyers frequently charge service fees that can range from 5–10% of the sale price. Additionally, after inspections, they may request repair credits or price adjustments that effectively reduce your net proceeds. Independent industry analyses have shown that once these fees and adjustments are accounted for, the seller’s net position can be similar to, or in some cases lower than, a traditional listing—despite the perception of a premium convenience product.

Another practical limitation is coverage and eligibility. iBuyers generally focus on specific markets, price ranges, and property types. Older homes, properties with significant deferred maintenance, or houses outside core metropolitan areas may not qualify. For owners of inherited homes or properties in secondary markets, the more flexible underwriting of a local professional investor is often more realistic. In such cases, the strategies in "How to Sell Inherited Property Fast: A Professional Comparison of Your Best Options" can help you weigh whether an institutional or local approach better fits your circumstances.

From a risk perspective, iBuyer and institutional investor transactions are typically well-organized, but they are also less flexible. Policies are set centrally, and local teams have limited discretion on exceptions. If you need customized solutions—such as unconventional closing timelines, complex title issues, or creative occupancy arrangements—a local direct home sale to investor may provide more options. Business professionals accustomed to negotiating bespoke terms may find the institutional model efficient, but less adaptable to unique constraints.

-

Highly digitized process with online offers and document handling

-

Most suitable for newer homes in strong, urban or suburban markets

-

Service fees and repair credits can materially reduce net proceeds

-

Coverage is limited; many properties do not qualify for an offer Criteria iBuyer / Institutional Investor Local Professional Cash Investor Offer generation Automated algorithms, online forms Property-specific analysis, direct review Service fees Often 5–10% of sale price Typically no service fee or commission Property condition tolerance Prefers move-in ready or lightly used Comfortable with significant repairs or as-is condition Flexibility in terms Standardized policies Negotiable, case-by-case solutions Market coverage Selective metro areas only Broader coverage across many U. S. cities

Pro tip: Before accepting an institutional or iBuyer proposal, request a detailed breakdown of all service fees, repair credits, and seller-paid costs. Comparing that net figure to a local direct home sale to investor offer will reveal which option genuinely maximizes your net proceeds for the same timeline.# 4. Option 3: Wholesalers and Assignment Investors

Wholesalers operate differently from direct buyers such as Casey Sullivan Real Estate. Instead of purchasing your property themselves, wholesalers typically place your home under contract at a discounted price and then assign that contract to another investor for a fee. This means the person you negotiate with initially may not be the ultimate buyer. While this approach is common in the investment community, it introduces layers of complexity and potential for misalignment between your objectives and the wholesaler’s incentives.

A wholesaler-driven direct home sale to investor can be very fast in theory, because wholesalers maintain networks of investors looking for discounted properties. However, the speed and certainty of closing depends on the wholesaler’s ability to find a buyer within the contractual timeframe. If they fail to assign the contract, you may face delays, renegotiations, or cancellations. Moreover, because wholesalers need to leave room for their assignment fee and the end buyer’s profit, the price they can offer is often significantly below both market value and the offers a professional end investor might provide.