Facing a relocation deadline, a looming foreclosure, or a property that needs more repairs than you want to fund? Cash home buyers can often close in days instead of months, but they are not the only option—and not always the best one financially. In this professional comparison guide, you will see where cash home buyers stand against traditional listings and newer hybrid approaches so you can choose the selling strategy that best aligns with your timeline, risk tolerance, and financial goals. Table of Contents

- Understanding Cash Home Buyers

- Cash Home Buyers vs Traditional MLS Listing Traditional listing through an agent remains

- Cash Home Buyers vs iBuyers

- Cash Home Buyers vs “For Sale By Owner” (FSBO) FSBO appeals

- Choosing the Right Type of Cash Home Buyer Not all cash home buyers operate

Key Takeaways Key Point Why

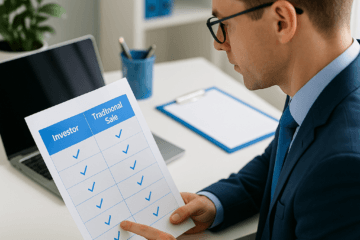

It Matters Best For Cash home buyers prioritize speed and certainty over price You trade some equity for convenience and risk reduction Sellers with urgent deadlines or distressed properties Traditional listing can maximize price but is slower and less predictable Showings, repairs, and buyer financing add complexity Sellers with time, flexibility, and updated homes iBuyers and institutional buyers are highly standardized Offers may be data‑driven with strict property criteria Newer homes in major metros with few condition issues FSBO can save commission but adds workload and risk You become your own agent and negotiator Experienced or highly motivated DIY sellers Not all cash home buyers are equal Vetting buyers protects you from delays and renegotiations Any seller considering a cash offer

Understanding Cash Home Buyers

and Your Main Selling Options Before comparing alternatives, it is important to define what “cash home buyers” are—and what they are not. Cash home buyers are individuals or companies that purchase properties using their own funds or verified private capital without relying on traditional mortgage financing. They typically: – Buy properties in as‑is condition – Close significantly faster than financed buyers – Simplify or eliminate contingencies

-

Focus on convenience and certainty rather than paying top‑of‑market retail prices By contrast, a traditional retail buyer usually depends on a mortgage, inspections, appraisal, and often repairs or concessions from the seller. Your main selling paths Most residential sellers considering cash home buyers are choosing among four primary options: – Traditional MLS listing with a real estate agent – Sale to a professional cash buyer or investment company – Sale to an iBuyer or institutional investor – For

-

Sale By Owner (FSBO), with or without a cash buyer involved For an in‑depth framework comparing “as is” cash sales, traditional listings, and hybrid models, see Casey Sullivan Real Estate’s guide, We Buy Houses As Is: Comparing Cash Buyers, Traditional Sales, and Hybrid Options.: Option Speed Predictability Typical Prep/Repairs Pricing Potential

-

Traditional agent listing Slow–Moderate Moderate High Highest potential

-

Professional cash home buyers Fast High Low Moderate–Lower

-

iBuyers / institutional Moderate–Fast High (if eligible): Low–Moderate Moderate

-

FSBO Variable Low–Moderate Variable Moderate–High (if executed well): Pro tip: Clarify your top priority (speed, net proceeds, or minimizing hassle) before you request a single offer; it will guide every decision you make.

-

Cash Home Buyers vs Traditional MLS Listing

Traditional listing through an agent remains the most common way to sell a home, especially when maximizing price is the primary goal. However, sellers facing time pressure, property condition issues, or financial distress often consider cash home buyers as a strategic alternative. How they differ in practice – Timeline- Traditional: 45–90+ days from listing

to closing is common, depending on market conditions. – Cash home buyers: 7–21 days is typical for professional buyers; some can close faster when necessary. -Condition and repairs- Traditional: Buyers frequently demand repairs after inspection; lenders may require certain conditions. – Cash home buyers: Usually purchase strictly as‑is and factor repairs into their offer. -Certainty of closing- Traditional: Deals can fall through due to financing, appraisal gaps, or inspection issues. – Cash home buyers: No financing contingency, and experienced buyers have extremely low fall‑through rates. -Carrying costs and stress – Traditional: Ongoing mortgage, taxes, insurance, utilities, and maintenance while the property is listed. – Cash home buyers: Shorter holding period can significantly reduce those costs and the disruption of showings. Pros and cons comparison Factor Traditional MLS Listing

Cash Home Buyers Sale price Highest potential, especially in hot markets Typically below retail, reflecting as‑is condition and investor margin Speed Slower; can be unpredictable Fast and highly predictable Repairs Often required or negotiated Usually none; sold as‑is Showings Multiple, ongoing Typically one or two brief visits Fees/commissions | 5–6% agent commission plus closing costs No commission; closing costs may be negotiable Control over timing Limited; influenced by buyer schedule and lender

When a traditional agent listing makes sense

-

You have a modern, well‑maintained property

-

You are not under time pressure to sell

-

You want to maximize your potential sale price

-

You are comfortable with showings and negotiations For sellers who can invest some time and effort, a traditional listing can still be the optimal route. To explore how to market your property without an agent while still appealing to retail buyers, review How to Sell My House Without a Realtor: A Step‑by‑Step Professional Guide. When cash home buyers are strategically better

-

You are facing foreclosure, divorce, probate, or job relocation

-

The home has significant deferred maintenance or code issues

-

You are managing an inherited property from out of state

-

You cannot or do not want to fund repairs, staging, or holding costs Pro tip: Do a quick “net sheet” comparison—estimate your after‑fee proceeds from an agent sale vs a cash offer after repairs, time on market, and carrying costs are factored in. The difference is often smaller than the headline sale price suggests. Cash Home Buyers vs iBuyers

and Institutional Investors In recent years, many sellers have received offers from iBuyers or institutional investors alongside local cash home buyers. While both are cash‑driven models, their approaches differ meaningfully. What are iBuyers and institutional buyers? – iBuyersare technology‑driven companies that make algorithm‑based offers, often online, within 24–48 hours. -Institutional investors include large funds or corporate buyers purchasing at scale for rentals or portfolios. Both typically focus on newer properties in major metropolitan areas and are less flexible on unique situations or heavily distressed homes. Comparing offers and terms Factor Local Cash

Home Buyers iBuyers / Institutional Investors Property criteria Broad, including older and distressed homes Narrow; often newer homes in specific zip codes Pricing model Neighborhood expertise, rehab cost analysis Automated valuations with standardized adjustments

Fees Typically no service fee or commission May charge service fees and repair deductions Flexibility High—tailored closing dates, creative solutions Moderate—structured processes and timelines Human interaction Direct access to decision‑makers

Pros of iBuyers/institutional buyers – Transparent, often software‑driven offer process – Potentially competitive pricing in select markets – Strong brand recognition and standardized procedures

Cons compared to local cash home buyers – Stricter property eligibility criteria – Possible additional fees (service fees, repairs) that reduce net proceeds – Less nuance for unique property challenges or complex personal situations

For a deeper dive into optimizing a quick cash sale in any condition—including when large buyers will not make an offer—review How to Sell My House Fast for Cash: A Complete Professional’s Guide. Pro tip: When comparing offers, focus on “net to seller,” not just the headline number. Deduct fees, repair credits, and your projected holding costs to understand the true value of each option. Cash Home Buyers vs “For Sale By Owner” (FSBO) FSBO appeals

to analytical and cost‑conscious homeowners, especially business professionals comfortable negotiating. It can be an effective strategy, but it requires time, skill, and a strong understanding of local market dynamics. How FSBO differs from selling

to cash home buyers – Marketing and exposure- FSBO: You are responsible for pricing, marketing, signage, photos, and online listings. – Cash home buyers: Marketing is irrelevant to you; the buyer already has capital and intent. -Negotiation and legal risk- FSBO: You handle all inquiries, offers, inspections, and contract terms yourself. – Cash home buyers: Typically use standardized contracts and provide a streamlined path to closing. -Timeline and certainty – FSBO: Can be unpredictable; may take longer than an agent‑listed sale, especially without MLS access. – Cash home buyers: Defined closing timelines, usually within days or weeks. FSBO vs cash buyers: pros

-

and cons Factor FSBO Cash Home Buyers Commission savings High (no listing agent): High (no listing agent)

Workload for seller High Low Buyer type Often financed buyers Cash, no financing contingency Legal/contract expertise needed Significant Moderate; professional buyers often guide process Ideal for Experienced DIY sellers in stable markets Sellers seeking speed, simplicity, or as‑is sale For step‑by‑step support in running a professional FSBO process, see How to Sell My House Without a Realtor: A Step‑by‑Step Professional Guide] and [7 Proven Strategies to Sell My Home Fast Without Losing Money. Where cash home buyers outperform FSBO -

You are not available to handle showings, calls, and negotiations

-

The property’s condition will deter traditional buyers

-

You need a defined closing date for a simultaneous purchase, move, or debt payoff Pro tip: Even if you plan to sell FSBO, obtain at least one reputable cash offer first. It becomes a benchmark and a backup plan if the retail route stalls or falls through. Choosing the Right Type of Cash Home Buyer Not all cash home buyers operate

the same way. The quality of your experience and your net outcome can vary widely depending on whether you work with a seasoned, well‑capitalized professional or an inexperienced wholesaler. Types of cash home buyers – Local professional investors- Direct buyers, often like

Casey Sullivan Real Estate

- Use their own capital or committed private funds

- Can close quickly and reliably -Wholesalers- Put your property under contract at a price that allows them to assign the contract to another investor for a fee – May not have funds themselves; closing depends on finding an end buyer -National brands and franchises

- Use standardized processes and branding – Often rely on local franchisees or partners for execution

Key criteria to evaluate – Proof of funds

and track record – Clear explanation of their valuation and offer – Transparency on fees and who pays closing costs – Flexibility on closing date and occupancy (e.g., post‑closing possession) – Reputation, reviews, and local presence Evaluation Question What You Want to Hear Red Flag Responses