In many real estate transactions, time is the most valuable asset.

Whether you are relocating for a new role, resolving an inherited estate, or mitigating financial risk, a quick closing home sale can directly impact your cash flow, credit profile, and long-term financial planning.

By applying a structured, professional approach, you can significantly shorten the time from offer to closing while maintaining clarity, control, and confidence throughout the process.

Table of Contents

- 1. Define Your Timeline and Choose

- 2. Use As-Is Cash Offers to Enable

- 3. Streamline Title, Liens,

- 4. Optimize Contract Terms

Key Takeaways Strategy Impact on Speed Risk Level Best

Use Case Sell As-Is to a Cash Buyer

Fastest (often 7–14 days)

Low (no financing contingency)

Need a quick closing home sale with minimal preparation Pre-Clear Title and Documents

Moderate–High (cuts days to weeks)

Low (reduces last-minute issues)

Any sale where closing date is time-sensitive Digital Closings & Professional Coordination

High (eliminates scheduling delays)

Low–Moderate Busy professionals, out-of-state owners, or inherited properties

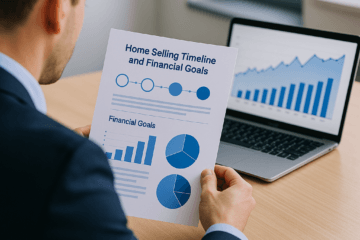

1. Define Your Timeline and Choose

the Right Sale Channel The foundation of a quick closing home sale is clarity on your timeline and constraints. Before you engage buyers or agents, determine your target closing date, minimum acceptable net proceeds, and any critical dependencies such as a job start date, debt payoff deadline, or move-out logistics. Business professionals frequently approach this the way they would any time-sensitive project: by defining objectives, constraints, and success metrics. Applying that same discipline to your home sale helps you select the appropriate strategy and counterparties. How to Sell My Rental Property With Tenants: A Step‑by‑Step Professional Guide] Most sellers default to listing on the open market with a real estate agent, expecting that higher potential sale prices will offset longer timelines and greater complexity. However, a traditional listing often comes with pre-listing repairs, showings, negotiation cycles, buyer financing contingencies, inspection delays, and appraisal risk. Each of these steps can add days or weeks and introduce uncertainty. For sellers who value speed and predictability, an alternative channel—such as selling directly to a professional home buyer—can be more aligned with their priorities. [7 Proven Strategies to Sell My Home Fast Without Losing Money] Casey Sullivan Real Estate operates in this alternative channel, focusing on purchasing residential properties in as-is condition from sellers who prioritize a quick closing home sale over maximizing every potential dollar on price. For some owners, particularly those who are relocating, handling an estate, or under financial pressure, the reduction in time, complexity, and stress delivers more value than attempting to extract a slightly higher price through a slower process. Hassle Free Home Sale: Comparing 5 Proven Ways to Sell Without the Stress] It is useful to evaluate the trade-offs between different sale channels in a structured manner similar to a business decision. Consider speed, certainty, required effort, and impact on your liquidity and credit.

Different situations call for different approaches, and aligning the channel with your objectives is the first step toward a disciplined, time-efficient transaction. How to Sell Inherited Property Fast: A Professional Comparison of Your Best Options

-

Clarify your ideal and latest acceptable closing dates.

-

Determine how important speed is relative to total net proceeds.

-

Assess your capacity to manage repairs, showings, and negotiations.

Sale Channel

Typical Time to Close

Seller Effort Level

Certainty of Closing Best Fit Traditional Listing (Agent + MLS) | 30–60+ days after offer

High (repairs, showings, appraisals)

Medium (financing and inspection risk)

| Direct Sale to Cash Investor | 7–21 days in many cases

Low (as-is, minimal showings)

High (no financing contingency)

| Hybrid / iBuyer or Investor + Agent | 14–45 days

Medium

Medium–High Balanced approach between speed and price

**

Pro tip:** Treat your home sale like a time-sensitive business project: write down your constraints, timeline, and risk tolerance before you speak with any buyer so you can quickly evaluate which offers realistically support a quick closing home sale.

2. Use As-Is Cash Offers to Enable a Quick Closing Home Sale One of the most effective ways to achieve a quick closing home sale is to eliminate financing and repair contingencies, which are two of the most common sources of delay and failed closings.

As-is cash offers from professional buyers remove the need for a lender’s underwriting, appraisals tied to loan approvals, and extensive repair negotiations.

This streamlines the workflow to a straightforward transaction focused on title verification, a basic property assessment, and closing documentation. [7 Proven Ways to Avoid Foreclosure Sell House Fast and Protect Your Equity] Traditional buyers often rely on mortgage financing, which can lengthen timelines and introduce last-minute risk if underwriting, appraisal, or credit issues arise.

By contrast, a reputable cash buyer typically has capital or established credit lines in place, allowing them to schedule closing as soon as the title is clear and the necessary documents are signed.

This can compress the transaction cycle from 30–60 days down to one to three weeks in many markets, sometimes even faster for simpler cases. We Buy Houses As Is: Comparing Cash Buyers, Traditional Sales, and Hybrid Options] Casey Sullivan Real Estate specializes in purchasing properties in as-is condition, which means you avoid both the direct cost and the time delay of pre-listing repairs.

For owners dealing with distressed properties, inherited homes, or rentals with deferred maintenance, this can be particularly advantageous.

If you are considering various ways to sell quickly, you can compare your options in detail using resources such as "7 Proven Strategies to Sell My Home Fast Without Losing Money" at caseysullivanrealestate.com and "We Buy Houses As Is: Comparing Cash Buyers, Traditional Sales, and Hybrid Options" at caseysullivanrealestate.com When assessing a cash offer, evaluate not only the purchase price but also your net proceeds after avoided costs, such as repairs, extended holding expenses, and the opportunity cost of a slower closing.

For business professionals, the ability to reallocate capital and attention quickly can have tangible economic benefits that extend beyond the nominal sale price.

-

Confirm proof of funds from any cash buyer.

-

Clarify the expected closing date and title company or attorney.

-

Ask for a clear breakdown of any fees or closing cost allocations.

Factor

Traditional Financed Buyer As-Is Cash Buyer Contingencies

Financing, inspection, appraisal Typically limited to title and basic inspection Repair Requirements

Often required before closing or credited Usually purchased strictly as-is Time to Close | 30–60+ days common | 7–21 days common Risk of Deal Falling Through

Moderate (loan denial, appraisal gap)

**

Pro tip:** When comparing a cash offer to a traditional listing, build a simple spreadsheet that includes repair estimates, mortgage and tax carrying costs for each additional month, and potential price reductions.

This often reveals that an as-is cash sale is more competitive than it appears at first glance for a quick closing home sale.

3. Streamline Title, Liens,

and Documentation Upfront Even when you have a qualified buyer and signed contract, title and documentation issues can derail a quick closing home sale. Common problems include unpaid property taxes, unresolved liens, judgments, missing probate documentation for inherited properties, or discrepancies in recorded ownership. Identifying and addressing these issues early can save days or weeks of back-and-forth during the closing process. A proactive title strategy mirrors standard practices in corporate transactions, where due diligence is front-loaded to reduce closing risk. Start by gathering core documents: your deed, recent mortgage statements, property tax records, homeowners association (HOA) information, and any prior surveys or title policies you may have. Having these readily available enables your title company, attorney, or buyer to accelerate the title search and clearing process. For inherited properties, ensure you have the appropriate court orders, letters testamentary, or affidavits required in your jurisdiction. For a detailed comparison of options tailored to inherited assets, consult "How to Sell Inherited Property Fast: A Professional Comparison of Your Best Options" at caseysullivanrealestate.com If the property has existing tenants, prior legal actions, or known liens, bring this information to the forefront when you first speak with your buyer. Professional buyers such as Casey Sullivan Real Estate are accustomed to working through these issues and may have established processes with title companies to resolve them efficiently. Concealing or delaying disclosure typically leads to unexpected closing delays and can jeopardize a quick closing home sale.

From a business perspective, think of title readiness as risk mitigation.

The more transparent and organized you are with documentation, the smoother the transaction becomes.

This approach keeps your closing timeline under tighter control and reduces the likelihood of last-minute renegotiations or contract extensions.

-

Collect deed, mortgage statements, and property tax records before listing or contacting buyers.

-

Disclose any known liens, judgments, or disputes at the outset.

-

Engage a reputable title company or attorney experienced in expedited closings.

Common Title Issue

Typical Impact on Timeline Mitigation Strategy Unpaid property taxes

Adds 3–10 days for payoff coordination Obtain payoff amounts early and authorize payment at closing Outstanding mortgage or HELOC

Adds 3–7 days Provide lender details and account numbers to title company early Probate or estate not finalized

Can add weeks if not pre-handled Work with an attorney to complete necessary probate steps before contracting Unknown liens or judgments

Variable; can delay closing significantly Run early title search and negotiate payoff or clearance before setting closing date

**

Pro tip:** Request a preliminary title search as soon as you are serious about selling, even before you sign a contract.

Spending a small amount of time upfront often prevents larger delays later and supports a faster, more predictable closing schedule.

4. Optimize Contract Terms

for Speed and Certainty Contract structure is a key driver of whether your transaction achieves a quick closing home sale or becomes subject to repeated delays. Many standard purchase agreements are drafted for conventional buyers and allow extended periods for inspections, financing approvals, and appraisal reviews. While these provisions protect buyers, they can be misaligned with sellers who prioritize speed. When working with a professional buyer or investor, you can often negotiate more streamlined terms that preserve fairness while reducing friction. The most important contract variables to consider are closing date, contingencies, access for inspections, and allocation of closing costs. Shorter inspection periods, limited to major structural or safety issues, can prevent drawn-out renegotiations. The removal of financing contingencies, which is typical with true cash buyers, further increases certainty. If you are trying to avoid foreclosure or serious credit impacts, aligning the closing date with lender deadlines is especially critical; for guidance on this scenario, see "7 Proven Ways to Avoid Foreclosure Sell House Fast and Protect Your Equity" at caseysullivanrealestate.com Clear expectations about what stays with the property and what you will remove can also eliminate last-minute disputes. In busy seasons or when relocating for a new role, you may prefer a post-closing occupancy agreement that allows you to remain in the property briefly after closing.

Professional buyers often accommodate this as part of a coordinated, businesslike transaction structure.